Healthcare plans can be so difficult to understand. During this 12 part series, Understanding your Insurance, we are breaking down each segment to enable you to make more informed healthcare decisions. Last month we examined Premiums, Deductibles and Co-Pays. There are 2 more elements that are crucial to understanding the basics of your healthcare plan, Coinsurance and Out-of-Pocket Maximums.

Coinsurance

Coinsurance is your share of costs for healthcare services. Coinsurance usually kicks in once you’ve met your deductible.

Let’s say your plan has a $5000 deductible, which you’ve hit. (Hitting your deductible means that you’ve paid both your monthly premiums and $5000 towards your deductible for the year.) Now, you are going in for an office visit that costs $200.

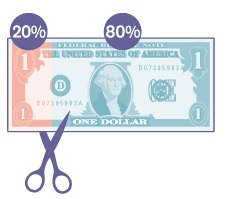

For the sake of this example, let’s say your plan does not require a copay. And let’s also say that your coinsurance amount is 80/20, meaning once you’ve hit your deductible, your insurance covers 80% of the cost of the visit/procedure and you cover 20%.

Deductible = $5000—paid in full

Coinsurance = 80/20 (plan pays 80%, you pay 20%)

Office Visit Cost = $200

Amount due = $40

In this example, you should receive a bill for $40 and your insurance will pick up the rest. So this means that even though you have reached your deductible, you will still incur medical costs. That is, until you reach your out-of-pocket maximum.

Out-of-pocket maximum

This number is pretty important; it is the most you have to pay for covered healthcare services in a year. This figure does not take into account services you receive that are not covered under your healthcare plan or your monthly premium. However, it does include your deductible, copays and coinsurance payments for the year. Out-of-pocket maximums usually differ between an individual and a family so make sure to familiarize yourself with your particular plan and options. People generally reach their out-of-pocket maximums during a year with high medical costs. Below is an example of how this all plays out:

Let’s say you need to have a surgery that will cost $20,000.

Your plan specifications are as follows:

- Deductible: $5000

- Coinsurance: 20%

- Out-of-pocket maximum: $7150

You pay the first $5000 of covered medical expenses towards your deductible.

Now, you owe your coinsurance amount on the rest of the medical costs of $15,000 for a total of $3000.

This brings you to a total of $8000. However, your out-of-pocket maximum is $7150. Therefore, you will only owe $2150 in coinsurance because that will get you to your out-of-pocket maximum amount of $7150. At this point, any additional covered medical costs you incur throughout the rest of the year will be covered by your insurance 100%. However, you are still required to pay your monthly healthcare premium as that is not included in your out-of-pocket maximum.

There we have the basics of healthcare costs incurred with healthcare coverage and medical visits. Next month we will explore what it means to be covered under more than one plan, or Coordination of Benefits.

Category: Uncategorized